Having dumpster rental insurance is about transferring some of the risks your business faces in its day-to-day operations in exchange for monthly payments in the form of premiums.

In the dumpster rental business, those risks are especially high. Dropping off containers on customer property and hauling thousands of pounds of debris to landfills leaves you open to liability exposures that make coverage a non-negotiable investment in this line of work.

What’s even more important, however, is having the right type of insurance. In dumpster rentals, you’ll need the type that will actually protect you when something goes wrong. Without it, you could find yourself holding the bag when an accident happens.

From being classified under the wrong business type by an inexperienced agent to not updating your coverage after expansion, there are several ways you can end up with coverage that doesn’t protect you when you need it.

Read on to learn about the most common insurance mistakes made in the dumpster rental industry; and how to avoid them.

TL;DR Summary

- Dumpster rental businesses are often misclassified and improperly insured

- Common mistakes include using the wrong auto coverage, underinsuring dumpsters and equipment, and not updating policies as the business grows

- Dumpster rental insurance gaps can result in denied claims and unexpected out-of-pocket costs

Misclassification of Insurance

Being classified correctly might seem like a minor technical detail, but it can make the difference between having a claim paid or paying out of pocket when something goes wrong.

Relatively few insurance agents will have the experience insuring dumpster rental businesses to understand the unique risks that come along with working in the industry. Often times dumpster rental companies find themselves working with agents who are unfamiliar with the industry and may classify them as a delivery service, trucking company, or even a construction contractor. Although those classifications seem “close enough” on paper, they don’t actually match what your business does or the specific risks that come with it.

The problem is your classification determines your dumpster rental insurance coverage. If your business is not classified correctly, then the insurance company can argue that it wasn’t insuring the risks you take every day like hauling debris and operating on customer property.

Even if you’re classified under a higher risk category than you should be, and paying higher premiums as a result, that still doesn’t guarantee you’ll be covered when it’s time to file a claim.

How to Get Your Dumpster Insurance Class Code Right

- Work with an agent who regularly insures roll-off dumpster rental businesses

- Have them specify the exact class codes they are writing your policy with and have them explain the use of those codes

- Review the specific risks your policy must cover, make sure damage to customer property and inland marine coverage are included

- If you’re not satisfied with the explanation, seek out another agent as getting the correct insurance policy could make or break your business

Before moving on, it helps to understand inland marine coverage and why it plays a key role in insuring dumpsters and equipment.

Using Personal Auto Insurance for Business Vehicles

When first starting their dumpster rental businesses, many owners make the mistake of operating their business with a personal auto policy. Common reasons for using a personal auto policy for a dumpster business include…

- Avoiding higher commercial premiums

- Started part-time and never updated coverage after going full-time

- Assuming a personal title/registration means personal insurance is fine

- Believing that local and part-time hauling isn’t business use

Running your dumpster rental business without a commercial vehicle policy is a major one. Personal auto policies are priced to cover personal driving, not roll-off dumpster deliveries.

Many of these policies exclude business use, have low liability limits, and don’t clearly cove trailers. This means that either your personal policy will not cover the costs or the claim could be denied outright for a lack of proper coverage.

How to Correct the Commercial Auto Coverage Gap

- Get a commercial auto policy with appropriate liability limits for any vehicles that are used for deliveries and pickups

- If your truck is personally titled, retitle the vehicle or ask about listing the business as additional insured

- List trailers, garaging locations, drivers, and actual use are accurately disclosed

- Consider an umbrella policy for extra protection

Learn more about commercial vehicle usage for dumpster rentals with our complete guide covering CDL Requirements for Dumpster Rental Businesses

Assuming a Low Premium Provides Real Coverage

Paying a lower premium always sounds good, until you find out the hard way about exclusions in your coverage. Policies that look similar on paper can result very differently for you on a claim. In dumpster rentals, a “low premium “cheap” policy could actually end up costing you more if you’re forced to pay damages out of pocket.

Beyond Commercial Auto policies, here are the other big coverage gaps in the roll-off dumpster rental industry:

- Common general liability exclusion clauses — like “care, custody, and control” (CCC) and “that particular part being worked on” — can disqualify site-damage claims (driveways, gates, masonry)

- “Off the shelf” general liability often excludes clean-up and third-party damage from spills probably isn’t going to include coverage for clean-up and damage from spills or leaks (hydraulic fluid, leachate, paints/solvents)

- Without an inland marine (equipment floater) policy, movable gear (pads, skates, tarps, hand tools, small equipment) isn’t fully protected in transit or on customer sites

- General Contractors and Landlords may demand proof of additional insured, primary/non-contributory wording, waiver of subrogation, and sometimes per-project/per-location aggregates—your policy must be able to meet these

Unfortunately, many roll-off operators only discover these gaps after a claim. The upside is you can close them with a few targeted endorsements and by structuring your policy specifically for roll-off work.

How to Close the Liability Coverage Gaps for Your Roll-off Business

- Tailor your General Liability for roll-off operations (ask how it handles customer-premises damage and CCC/“that particular part being worked on” exclusions)

- Add a pollution (sudden & accidental) endorsement for spills/leaks tied to your operations

- Add inland marine (equipment floater) so tools and portable gear are covered in transit and on site

- Meet contract requirements: confirm you can issue Certificates of Insurance (COIs) with additional insured, primary & non-contributory, and a waiver of subrogation; add per-project/per-location aggregates if required

With these gaps closed, a claim is far more likely to be paid—not challenged.

Not Updating Your Policy as You Grow

The previous sections were about getting the right kind of coverage when starting your dumpster rental business — which is huge. But the “right coverage” isn’t a one-and-done. As your business grows, your exposure changes. it will need to be updated as your business grows. You need to keep your coverage in sync so claims get paid and audits don’t cost you.

How Carriers Rate Dumpster Rental Businesses

Insurers price commercial policies based on what you report. For a roll-off dumpster company, they typically look at:

- Changes in your truck fleet including adding/selling trucks, new drivers, changes to garaging locations

- Additional dumpsters (count/value), pads/skates, and yard equipment that you have purchased

- An expansion of your operating area or entering new cities/counties/states

- Updates to services offered like adding heavier materials (concrete/dirt), roofing programs, commercial contracts, or use of subcontractors

- Any bigger jobs that contractually require additional insured, primary/non-contributory, waiver of subrogation, per-project/per-location aggregates, or higher umbrella limits

- The addition of new employees or a changing payroll mix

If you don’t update these items as they change, you risk having gaps for claims, and you might even have to pay higher premium penalties after an end-of-year audit.

Signs That You Need to Update Your Policy

You want to be proactive about updating your policy, so updated your policies as soon as things change, not just when it’s time to renew.

How to Keep Coverage Aligned With Business Growth

- If you’re adding dumpsters, drivers, trucks, and revenue, update your coverage mid-term. Don’t wait until the end of your term to tell your agent

- Make sure subcontractors that you work with have their own coverage (liability, auto, etc.) and matching COIs

- Keep updated, easy to follow records of your fleet, dumpsters, equipment, revenue, payroll, contracts, COIs, claims and incidents, safety inspections, and a change log

- Conduct your own scheduled audits on a quarterly schedule and update your agent with any changes

Dumpster rental insurance isn’t a one-time task. As your business grows—adding trucks and dumpsters, expanding your service radius, accepting heavier materials, hiring staff, using contractors, and bidding for bigger jobs—you need to be proactive about updating limits, endorsements, and records so your coverage matches your current exposure, you get your claims paid, and you avoid getting hit with a bill after an audit.

Underinsuring or Overinsuring Dumpsters

Dumpsters are not assets that gain value with age. Most roll-off containers need to be replaced every 10-12 years depending on usage, weather exposure, and how well they’re maintained. The better care you take to maintain your dumpsters, like weatherproofing, winterizing, cleaning regularly, and setting clear load requirements, the longer your dumpsters will last.

They are also not cheap to replace, as a lower end 20-yard dumpster cost upwards of $3,000. But if you value your dumpsters too low you’ll end up short after a claim and if you value them too high, you’ll be overspending on your premium.

You want to aim to keep your values accurate and have your coverage reflect that so your cans are protected in the yard, on the truck, and on customer sites.

Insuring Your Dumpsters Properly

Dumpsters are typically insured on an inland marine policy so they are always covered even though they’re being moved to different locations.

Follow these guidelines when insuring your dumpsters:

- Have your cans insured on an inland marine policy so they are covered in transit and on site, not just at your yard

- Declare the value of your dumpsters as their current cost of replacement, not what you originally paid for them. Keep in mind that the cost of dumpsters will fluctuate due to changes in the steel market

- Once you have 15-20 cans you should get blanket coverage and schedule any special or high-value types of dumpsters

- Choose a deductible that you can easily pay, avoid co-insurance penalties by keeping your values as accurate as possible

- Some policies exclude coverage for a “mysterious disappearance.” Brand your cans, mark them with IDs/serial numbers, and keep photo records of each of your cans

Signs Your Dumpsters Are Under- or Overinsured

- You haven’t updated your dumpster values in over a year

- You’ve added or sold a lot of cans since your last renewal and haven’t updated your limits or schedules

- You dumpsters are only insured on the premises of your storage lot

- You don’t have ID/serial logs if the dumpster is missing or stolen

- Paying a deductible would severely disrupt cash flow

Ensure Accurate Coverage of Your Dumpsters

- Update replacement costs and your blanket or schedule limits every year

- Keep a registry of your dumpsters that has a reference for dumpster ID/serial, size, purchase date, current replace value, and last location

- Confirm that your inland coverage extends to off-site and in-transit protection, with theft and vandalism included

- Choose a deductible that weighs lower premiums against what you can cover out-of-pocket

- Taking before and after photos of your dumpsters will go a long way to support your claims

Neglecting Umbrella and Specialty Policies

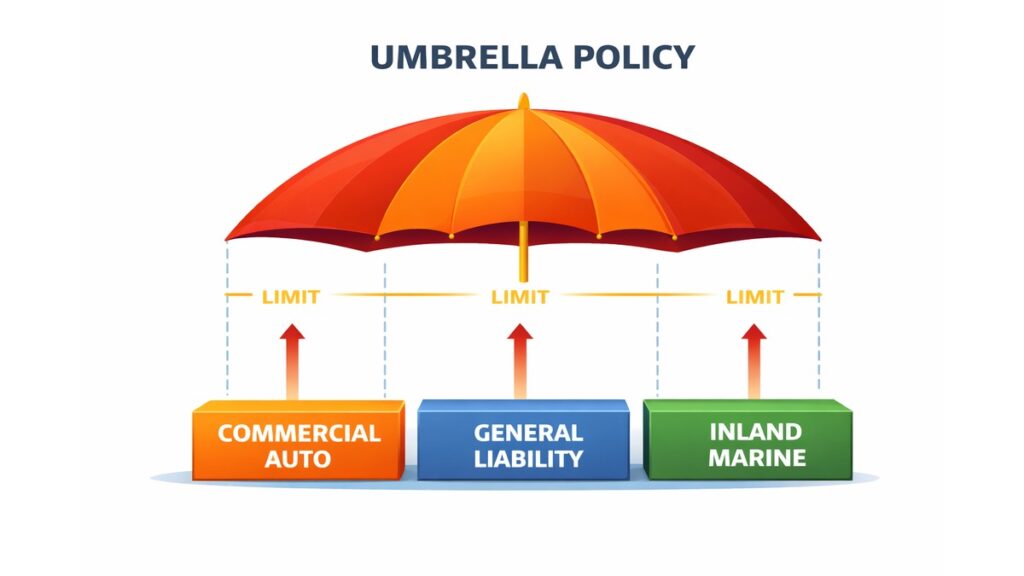

An umbrella policy provides an extra layer of coverage on top of your existing general liability, auto, or inland marine policies. Even though an umbrella policy isn’t a “non-negotiable” in the dumpster rental industry, it’s still a smart safeguard.

This added protection can make a big difference in the dumpster rental business, where one accident or claim can quickly exceed standard coverage limits. Adding an umbrella policy is an inexpensive way to protect you against catastrophic losses that would otherwise come out of pocket.

Signs You Might Need an Umbrella Policy

Not every dumpster rental business needs an umbrella policy, but some face higher risks than others. Here are a few signs it might be a good fit for you:

- You frequently operate trucks on public roads or near customer property (accidents involving vehicles or equipment could easily exceed your current liability limits)

- You’ve grown your business with multiple employees, trucks, or dumpsters (more moving parts mean more exposure to large claims)

- You have contracts with municipalities, large companies, or property managers (these often require higher liability limits than your standard policy provides)

- You store dumpsters, vehicles, or equipment on customer sites or shared lots (damage or injury could lead to multi-party claims)

How to Decide if an Umbrella Policy Is Right for You

There isn’t a “one-size-fits-all” umbrella policy for dumpster rental insurance. The best way to see if it makes sense for your dumpster rental business is to talk to your agent and discuss your current coverage in detail. You want to figure out where your current policies end and where major financial exposure begins.

These are some key questions to ask your agent:

- What are the liability limits on my current general liability and auto policies, and what kinds of claims could exceed them?

- If a serious accident were to happen, what’s the most my business could realistically be responsible for out of pocket?

- How much additional coverage would an umbrella policy provide, and what would it cost per year?

- Would an umbrella policy cover all areas of my operation including all my business vehicles, drivers, and property damage exposures?

Once you gather this information, you can weigh the cost of an umbrella policy against your level of risk. If your business regularly operates in high-traffic areas, takes on large contracts, or stores equipment on customer property, that small extra premium could easily be worth it for the peace of mind and financial protection.

Close Dumpster Rental Insurance Gaps, Gain Peace of Mind — How DRS Keeps You Covered

Insuring your business to protect against the built-in risks that come with hauling roll-off dumpsters isn’t just about policies and paperwork — it’s about staying organized, keeping accurate records, and having a clear picture of where your business is now and where it’s headed.

That’s where Dumpster Rental Systems (DRS) simplifies things.

One of our software’s core features is real-time inventory management, which lets you view and update all of your dumpsters and equipment instantly. This makes it easy to keep a running record of your assets which is a huge advantage when you need to update your agent about new purchases or submit documentation to support a claim.

DRS also provides detailed financial reporting, giving you clear insight into your revenue, expenses, and payroll. These reports make it simple to evaluate your insurance costs and supply accurate numbers when purchasing or renewing coverage.

In addition, DRS offers website services that will build a high-ranking website for your business that converts efficiently and builds a strong, professional online presence for your business. Your website can feature your dumpster rental availability, pricing, and insurance coverages, which will build trust with potential customers — especially contractors and commercial clients.

And because DRS is built specifically for the dumpster rental industry, you’ll also have access to:

- Online booking for easier scheduling

- Optimized routing for deliveries and pickups

- Integrated payments for seamless transactions

- Built-in marketing tools to promote your business

All in all, DRS does a lot more than simplify managing dumpster rental insurance — it’s an all-in-one system that simplifies your entire operation and keeps your business organized, efficient, and built for growth.

Contact us to learn more or schedule a demo and see how DRS can make running your business easier than ever.

Frequently Asked Questions

What Kind of Insurance Does a Dumpster Rental Business Need?

Most dumpster rental companies need a set of policies that cover the liability of their business, the vehicles they use for business purposes, and the equipment they rely on to carry out daily operations (dumpsters, pads, and skates).

These coverages would be represented by general liability insurance that protects your business if a third party is injured or their property is damaged as a result of your work (for example, if a dumpster damages a customer’s driveway). Commercial auto insurance that covers your trucks and drivers while hauling dumpsters or driving between job sites (this includes accidents, injuries, and vehicle damage that occur during business use). And finally, inland marine coverage that protects your dumpsters and other mobile equipment in all locations it is left at (your property, at a customer’s site, or in transit). Depending on your contracts, service area, or the size of your business, you might also need workers’ compensation and an umbrella policy for added protection against high-value claims.

How Often Should I Update My Dumpster Rental Insurance Policy?

You should review your policy at least once a year or whenever your business adds assets or takes on exposures that your current coverage doesn’t extend to. This could be adding new trucks, dumpsters, employees, or expanding your service radius. Keeping your policy up to date helps you close coverage gaps before they happen, prevent costly claim denials later on, and avoid penalties from audits.

How Does DRS Help with Managing Insurance Coverage for Roll-off Dumpster Rental Businesses?

DRS makes it easy to track your assets, view up-to-date financial reports, and generate accurate records that your insurance agent can use to keep your coverage current. You can instantly update your inventory, document purchases, and export reports — all in a single dashboard. This level of organization is essential for managing a growing business and ensuring it stays protected.

Is an Umbrella Policy Necessary for My Dumpster Rental Business?

An umbrella policy isn’t something most dumpster rental businesses need right away, but it’s worth considering once your operation is established and starting to scale. As your business grows, you’re adding more dumpsters, managing more trucks and employees, and taking on larger projects — all of which increase your potential exposure if something goes wrong. When your business reaches the growth stage, the additional premium for an umbrella policy can be a worthwhile investment. As it helps protect the momentum and equity you’ve built, giving you added peace of mind that a single accident or claim won’t undo years of hard work and progress.

The information in this article is for educational purposes only and should not be considered financial, business, or legal advice. Insurance rates and requirements can vary widely based on location, business size, operations, and requirements. Always do your own research and consult a qualified professional before making any decisions regarding insurance or finances.